Strategic Fundraise

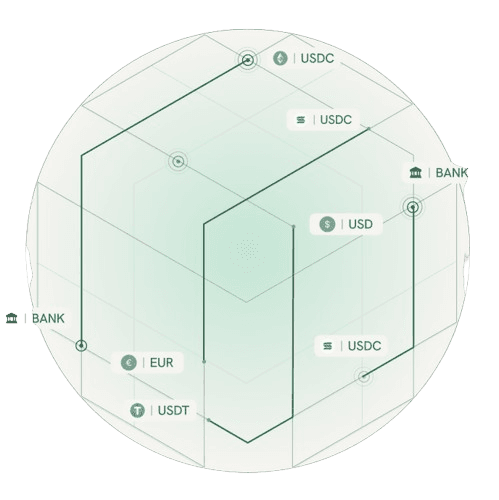

Digital Assets • Stablecoins • Onramps • Offramps • Identity • Network

Jan 14th, 2026

Crypto Stack • Onramps • Offramps • Payments

Unlocking Crypto with Onramps and OfframpsJune 5th, 2023 | 10 mins

Web3 is the next generation of the internet that promises to revolutionize the fintech space. Unlike Web2, which is built on centralized platforms, Web3 is decentralized, transparent, and gives power back to users. Cryptocurrencies play a crucial role in the Web3 ecosystem, providing the foundation for DeFi applications, NFTs, and more.

One of the key players driving crypto adoption is crypto onramps and offramps (also known as ramps). As the Web3 ecosystem evolves, cryptocurrencies and ramps are becoming increasingly important as they enable a seamless user experience, driving a new era of innovation in the digital economy.

Crypto onramps are gateways that allow users to convert traditional fiat currencies into digital assets. Conversely, crypto offramps allow users to convert their digital assets to fiat. These ramps enable the seamless flow of value across the Web3 ecosystem.

While this sounds so simple, it's quite an involved process. Before the advent of ramps, getting users to buy cryptocurrencies was a high-friction process involving several steps and multiple platforms. However, with the emergence of these providers, this process has become significantly easier - primarily since they handle the following functions:

KYC

To comply with regulatory requirements, ramp providers perform Know Your Customer (KYC) checks to verify the identity of users. This helps prevent fraud, money laundering, and other illegal activities.

Crypto Liquidity sourcing

Onramp providers plug into multiple liquidity providers such as Coinbase Prime, Binance, Kraken, and more to deliver crypto to the end users' self-custodial wallets. This ensures that customers can access various cryptocurrencies and buy or sell them at competitive prices.

Payment processing

By plugging into multiple payment processors such as Checkout, Stripe, and more, ramps allow your customers to make crypto transactions using various payment methods - both mainstream and hyperlocal. Examples include ACH, credit cards, Google Pay, PIX, IMPS, and more.

Onramps and offramps have played a significant role in driving the adoption of cryptocurrencies and enabling more people to participate in the Web3 ecosystem.

Banxa:

An Australian-based payment service provider with a strong focus on security and compliance, Banxa has become a trusted name in the cryptocurrency industry.

Binance Connect:

A service offered by Binance, the world's largest cryptocurrency exchange, Binance Connect has become a popular choice for developers needing a fast and easy way to enter the cryptocurrency market.

BTCDirect:

A hyperlocal platform in the European Union that allows users to buy and sell cryptocurrencies using Euros and payment methods iDEAL and SEPA.

Moonpay:

A UK-based platform, Moonpay is known for its user-friendly interface, fast transaction times, and competitive fees.

Onramp Money:

A hyperlocal platform in India that enables seamless, instant transactions for crypto users in India using local payment methods such as UPI and IMPS.

Ramp Network:

A UK-based platform, Ramp Network, is known for its decentralized architecture, low fees, and fast transaction times.

Sardine:

A platform that enables users to buy cryptocurrencies using their credit/debit cards or bank transfers. It is known for its fast transaction times, competitive fees, and wide range of supported cryptocurrencies.

Simplex:

An Israeli-based platform that enables users to buy cryptocurrencies using credit/debit cards and local payment methods like PIX. Its fraud prevention technology and strict regulatory requirements make it a trusted name in the industry.

Transak:

A UK-based platform that enables users to buy and sell cryptocurrencies using bank transfers and a host of local payment methods.

While each onramp and offramp possesses unique strengths, no single gateway can boast that they support every token, fiat currency, country, and local payment method. By only integrating with one or two gateways, developers immediately constrain their TAM and lower their conversion rates and revenue.

Despite the critical role onramps and offramps play in bringing in users to the Web3 fold, developers implementing their solutions still face a variety of challenges, including:

1. Incomplete coverage across countries, fiat currencies, payment methods, and tokens

Not all onramp and offramp providers support the same countries, fiat currencies, payment methods, and tokens. This can lead to a fragmented user experience, with potential users unable to buy or sell their desired cryptocurrencies using their preferred payment method in their country.

2. Low conversion rates with just a single gateway

Aside from incomplete coverage, your conversion rates are impacted by the KYC limits of each gateway. Each provider has their own KYC tiers, which affects the number of transactions and amount of crypto a consumer can purchase. Clearing each KYC tier can be arduous and discourage consumers looking to safeguard their personal information from making a transaction. Working with a single gateway automatically means constraining your conversion rates and revenue.

3. High spot prices and fees = poor customer experience

Spot prices and gas fees are subject to change and, aside from market fluctuations, wholly dependent on the service provider you choose to integrate with. This is a poor experience for your customers and can lead to an increase in churn if users feel they are being charged too much.

4. Working with multiple gateways is a challenge

Integrating with multiple onramp and offramp providers is challenging to manage in-house. It requires a team to oversee and implement - which means fewer engineering resources working on your core product.

These are additional hurdles that developers need to consider and address on top of the challenges that already exist when building a new product. Or at least that's how it used to be.

Meld's core purpose is to help developers build multi-vendor fintech stacks. We give developers the tools to take control of the spaghetti of integrations needed to create a robust customer experience. With just a few lines of code, developers can:

1. Increase coverage with every gateway added

Developers can boost conversion rates by 55% with Meld and unlock customers across:

• 200+ countries

• 113 fiat currencies

• 500+ crypto tokens

• 50+ payment methods

Learn more about Meld's coverage in our documentation! Contact us to get access.

2. Increase conversion using features like Meld’s Smart Routing

Route your customers to the ramp with the highest chance of conversion with Meld's Smart Routing feature. Taking factors like customer location, fiat currency, token, KYC limits, and more, we route each of your customers to the service provider with the highest chance of conversion.

3. Design your own UI or launch faster using our prebuilt UI

Developers can design their own UI powered by Meld's Crypto Stack or use our prebuilt and co-branded crypto wizard. Designed with your customers in mind, Meld's Crypto Wizard lets developers launch faster than ever.

4. Lower costs

Refocus engineering resources on your core product instead of onramps and offramps. Meld's unified platform was built with developers in mind. With a single and easy-to-maintain integration, developers get access to a Crypto Stack that constantly improves with new features and gateways added every sprint.

Whether through wallets, exchanges, swaps or even gambling platforms, onramps and offramps enable a wide range of use cases across the crypto ecosystem.

As developers look to leverage the potential of onramp and offramp providers, they can turn to Meld to simplify managing their Crypto Stack. We work on maintaining your Crypto Stack so you can focus on creating innovative experiences for your customers. Onramps and offramps have the potential to unlock the full potential of Web3 and drive the next phase of innovation in the fintech space.

Learn more about Meld's Crypto Stack here.

Q: What is Polygon/Matic, and how can I buy it?

Polygon (formerly known as Matic) is a Layer 2 scaling solution for Ethereum that aims to improve its speed and cost-efficiency. You can buy Polygon/Matic on various cryptocurrency exchanges such as Binance, Coinbase, and Kraken using fiat currencies or other cryptocurrencies.

Q: What is USDC coin, and how can I use it with crypto onramps/offramps?

USDC is a stablecoin that is pegged to the US dollar, which means that its value is relatively stable compared to other cryptocurrencies. You can use USDC on various onramps and offramps to buy or sell other cryptocurrencies such as Bitcoin, Ethereum, or other altcoins.

Q: Can I buy AVAX using a Solana wallet?

No, AVAX is a cryptocurrency that runs on the Avalanche network, and it cannot be purchased using a Solana wallet. However, you can purchase AVAX on various cryptocurrency exchanges.

Q: How can I use Google Pay or Apple Pay to buy cryptocurrency?

Many onramps support the purchase of crypto using payment methods like Google Pay and Apple Pay. By integrating with these service providers you can offer these payment methods to your customers.

Strategic Fundraise

Digital Assets • Stablecoins • Onramps • Offramps • Identity • Network

Jan 14th, 2026

Introducing Meld Network: Access Digital Assets Anywhere

Digital Assets • Stablecoins • Identity • Network

Nov 18th, 2025

Meld Partners with Phantom to Enhance Global Crypto Access

Aug 19th, 2024