Strategic Fundraise

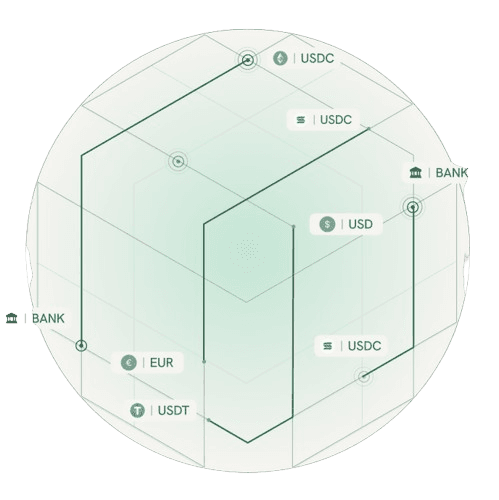

Digital Assets • Stablecoins • Onramps • Offramps • Identity • Network

Jan 14th, 2026

Bank Linking Stack • Data Connectivity

Making Bank Linking Work with MeldSeptember 3rd, 2022 | 9 mins

Account aggregation providers are crucial for seamless data sharing and streamlined financial management in today's rapidly evolving fintech landscape. As data aggregation becomes increasingly vital to the success of fintech solutions, the demand for effective account linking and data retrieval tools has never been greater.

Account aggregation providers are crucial for seamless data sharing and streamlined financial management in today's rapidly evolving fintech landscape. As data aggregation becomes increasingly vital to the success of fintech solutions, the demand for effective account linking and data retrieval tools has never been greater.

Bank-linking data aggregators are fintech companies specializing in accessing and consolidating data from various financial institutions, providing developers with a unified view of their customers' financial accounts, transactions, and investments. Access to this Consumer Permissioned (sometimes called User Permissioned) Financial Data has allowed developers to built a dizzying array of innovative products and services across banking, lending, investing, and personal finance management domains. And that's just the beginning. As data access continues to expand and technologies continue to improve, it's a safe bet we'll continue to see an explosion of products and services.

Let's take a closer look at some key players in this space:

Akoya

Akoya is owned by a consortium of banks and focused on providing oAuth connections across a select group of financial institutions.

Fincity

Owned by Mastercard, Finicity has built a reputation for ensuring that financial information is handled carefully and enables businesses to access their customers' financial data effortlessly.

MX

By harnessing the power of clean, categorized, and comprehensive data, MX empowers its clients to create personalized experiences and drive customer engagement.

Plaid

With a focus on user experience, security, and reliability, Plaid has become the go-to choice for many startups and established businesses alike.

Salt Edge

Primarily focused on Great Britain and European Union markets, Salt Edge helps businesses gain access to global financial data through a single API integration and offers a comprehensive suite of account aggregation solutions.

Sophtron

Sophtron excels in delivering cutting-edge data analytics and machine learning capabilities, enabling businesses to make data-driven decisions with ease and precision.

Teller

Using innovative mobile API access, Teller offers seamless connectivity to a variety of financial institutions while maintaining high data protection standards.

Yodlee

A pioneer in the account aggregation space, Yodlee has offered data aggregation and analytics solutions for over two decades using an extensive network of global financial institutions. Yodlee has been historically more focused on brokerage and wealth management data.

While each data aggregator possesses unique strengths, no single aggregator can boast complete coverage and stable connectivity rates across the entire spectrum of financial institutions.

Despite the critical role aggregation providers play in fintech's meteoric rise, the developers implementing their solutions still face a variety of questions and challenges. Let's take a look at the most pressing ones:

Limited coverage

No one aggregator offers complete coverage. In order to support all the banks and financial institutions in the U.S., Canada, or European Union, developers need to work with and build integrations into multiple providers. To make matters worse, coverage changes daily and it isn't clear which set of providers a developer can rely on for complete and consistent coverage.

Not all connections are created equal

Not all the connections you make to your customers' bank accounts are the same, and the differences can have important implications for data security, data accuracy, and connection fidelity. Some connections are 'OAuth connections,' where the use of password credentials is replaced with authorization tokens. Some are direct API connections, and others are powered by what is commonly called 'screen scraping.'

While the gold standard is indisputably the OAuth connection, not all providers support it, and you could be stuck pulling down inaccurate data via screen scraping connections if you rely on only one aggregation provider.

Working with multiple providers is a challenge

As a developer, even if you’ve made the decision to work with multiple account aggregators to overcome the limitations of working with one, you’re still not out of the woods. How will you route among the providers you choose to work with? You’ll need to build a dynamic routing engine that can handle the task. How will you standardize all the data you receive from these aggregators? That’s a time-intensive process, and you’ll need to invest a substantial amount of resources doing it. Meanwhile, you risk diverting focus away from your core product.

The challenge only intensifies as the number of data aggregators grows. Scaling and maintaining multiple integrations is costly, and complexity multiplies with every additional integration.

Meld’s core purpose is to help developers build multi-vendor fintech stacks. Meld gives developers the tools they need to create easy and accessible bank linking experiences. With just a few lines of code, developers can connect to the 13,000+ banks and financial institutions in the U.S. and Canada alone. Meld’s modular platform allows developers to take control of their integrations to unlock innovative use cases and build robust consumer experiences across ACH and bank-to-bank payments, personal finance, underwriting, and more.

Learn more about Meld's story and our founders' vision here

Meld’s Bank Linking Stack is a core platform that helps developers integrate multiple bank linking providers through a single integration. Here's how Meld helps you make bank linking work:

Increase coverage with every integration added

By supporting multiple providers, developers can expand their coverage and accommodate customers who bank with various institutions - including the longtail. Increase conversion rates by 55% and directly impact your bottom line.

Add redundancy to your bank-linking connections

Meld's platform provides redundancy in bank-linking connections, allowing developers to avoid a single point of failure for institutions - improving the reliability of your product for your customers. Using Meld-built features, like Smart Routing, developers can intelligently direct requests to the most optimal service provider, further enhancing the performance and reliability of your bank-linking stack.

Scale and grow faster

Meld is designed to work right out of the box while keeping your customer's experience in mind. Developers can launch products faster than ever with our prebuilt UI and unified data model.

Lower costs

Meld's platform lets developers focus their resources on their core products rather than the service providers supporting them. Reduce costs and free up resources to invest in innovation and growth.

The impact account aggregation providers have had on all the innovations surrounding financial services over the last decade or so cannot be understated. We’ve seen an explosion of applications serving an endless set of needs. We’ve lived through the great ‘unbundling.’

By leveraging Meld's integration, developers can redirect their time and energy toward building their core product. Whether you're looking to improve account verification, gather robust transaction data, improve conversion rates, or more, Meld is here to help make bank linking work according to your needs. We're your Fintech Stack as a Service.

Learn more about how Meld can make bank linking work for you here

Q: What is user permissioned data, and why is it essential for account aggregation providers?

User permissioned (also known as Consumer Permissioned) data refers to financial data that users have authorized to be shared with third-party providers. Account aggregation providers rely on user-permissioned data to provide financial services effectively while ensuring user privacy and data protection.

Q: What are account aggregation providers?

Account aggregation providers are financial technology companies that specialize in consolidating financial data from multiple sources and presenting it to users in a unified view. These providers enable users to manage their finances more efficiently by giving them access to all their financial data in one place.

Q: What is a data aggregator, and how does it differ from an account aggregation provider?

A data aggregator is a company that collects data from multiple sources and consolidates it into a unified format. Account aggregation providers are specific data aggregators that focus on reducing financial data from various financial institutions into a unified view.

Q: What are financial aggregators, and how do they differ from data aggregation companies?

Financial aggregators aggregate data from multiple financial sources and provide insights and analysis. On the other hand, data aggregation companies focus on consolidating data from various sources into a unified format and presenting it to users in a user-friendly manner.

Q: What are the benefits of using data aggregation companies?

Data aggregation companies provide users with a unified view of their financial data, making it easier to manage their finances. These companies also enable third-party providers to offer more innovative financial services by providing access to comprehensive financial data.

Q: How can account aggregation providers ensure the security and privacy of user data?Account aggregation providers use various measures to ensure the security and privacy of user data, including encryption, access controls, and other security protocols. These providers also adhere to data protection regulations such as GDPR and CCPA to handle user data carefully.

Strategic Fundraise

Digital Assets • Stablecoins • Onramps • Offramps • Identity • Network

Jan 14th, 2026

Introducing Meld Network: Access Digital Assets Anywhere

Digital Assets • Stablecoins • Identity • Network

Nov 18th, 2025

Meld Partners with Phantom to Enhance Global Crypto Access

Aug 19th, 2024