Introducing Meld Network: Access Digital Assets Anywhere

Digital Assets • Stablecoins • Identity • Network

Nov 18th, 2025

Crypto Stack • Onramps • Offramps

Simplifying Crypto Purchase with One Click CheckoutsJanuary 8th, 2023 | 5 mins

As the crypto industry evolves, the demand for seamless and secure online transactions is soaring. Users seek hassle-free ways to purchase digital assets, emphasizing streamlined onramping flows. The answer? Low KYC flows and one-click checkout. Learn how Meld creates smoother, faster transaction experiences for your users.

KYC, or Know Your Customer, is a regulatory process used by financial institutions, including crypto platforms, to verify the identity of their clients. The purpose of KYC is to prevent illegal activities like fraud, money laundering, and terrorist financing by ensuring that users are who they claim to be. However, this causes friction in the onboarding process leading to drop-offs.

Low KYC simplifies this verification process by requiring minimal information, often leveraging existing data from trusted sources like mobile wallets (ex: Apple Pay) and other sources. This streamlined approach significantly enhances the user experience by reducing the time and effort needed for verification. Users can quickly and easily purchase digital assets without the lengthy and cumbersome traditional KYC procedures. This not only speeds up transactions but also lowers the barriers to entry. Users in regions with limited banking infrastructure can greatly benefit from Low KYC, which fosters broader adoption.

In a typical KYC flow for onramping, users are required to fill out detailed forms and upload various identification documents, such as a driver’s license, passport, or other government-issued IDs. Some exchanges may even request a short video or photo of the user holding these documents, along with proof of residency, full name, and date of birth. This manual verification process can cause significant delays, preventing users from quickly accessing cryptocurrencies.

One-click checkout revolutionizes this process by allowing users to make purchases with fewer, and sometimes, a single click. By leveraging saved user details from mobile wallets like Apple Pay, the need for manual data entry and document submission is eliminated.

This not only speeds up the transaction process but also reduces the friction associated with traditional KYC methods. Although not all onramps support this feature yet, its adoption is growing, signaling a significant trend toward more user-friendly crypto transactions.

For users, integrating Low KYC and one-click checkout options provides enhanced convenience, faster transactions, and a simplified user experience. This reduces the barriers to purchasing cryptocurrencies, making the process more accessible and user-friendly.

For developers, these features lead to increased conversion rates by reducing friction in user onboarding. Streamlining the KYC process means users are less likely to abandon the sign-up process, resulting in improved customer satisfaction.

Overall, this Low KYC and one-click checkout fosters a more efficient and enjoyable experience for both users and developers, driving growth and engagement in the crypto market.

An important caveat is that Low KYC transactions are ultimately approved or rejected by each specific service provider according to their own compliance and risk policies.

Meld’s robust API allows developers to easily add onramps, including Low KYC options like Paybis, Topper, and Blockchain.com, as well as any of our other 17+ onramps. Additionally, Meld’s customer score leverages a user’s past transaction performance and other factors to intelligently recommend the onramp with the highest chance of success.

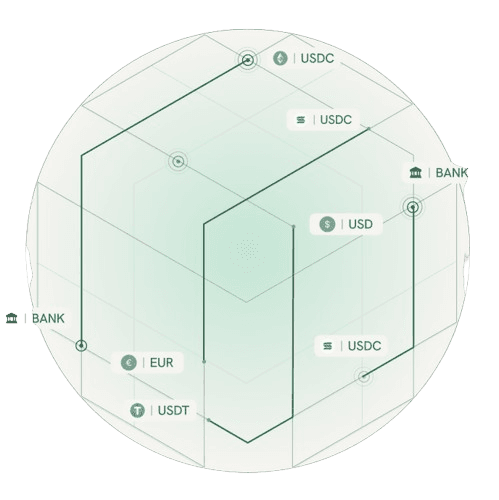

Our Crypto Stack ensures your users can speedily and securely onramp with minimal verification requirements, enhancing user experience and maximizing conversion rates.

Low KYC flow and one-click checkout are revolutionizing the crypto service industry by providing users with enhanced convenience, faster transactions, and a simplified experience. These processes significantly increase conversion rates and reduce onboarding friction for developers.

Meld's Crypto Stack amplifies this impact by enabling developers to create a versatile crypto stack that seamlessly supports onramps offering these cutting-edge solutions. As the digital currency revolution continues, streamlined KYC processes and user-friendly checkout options will become increasingly central, driving growth and engagement in the dynamic world of cryptocurrency.

Meld is empowering developers to build a Multi Vendor Stack and launch faster than ever! Learn more about how to launch in weeks instead of sprints here.

Q. What is KYC and why is it important in the crypto industry?

KYC, or Know Your Customer, is a regulatory process used to verify the identity of clients. It helps prevent illegal activities like fraud and money laundering by ensuring that users are who they claim to be. Traditional KYC requires extensive documentation, but Low KYC simplifies this process, making it faster and more user-friendly.

Q. How does one-click checkout with Apple Pay work for buying cryptocurrencies like Bitcoin and Ethereum?

One-click checkout allows users to purchase cryptocurrencies seamlessly by using saved details from mobile wallets like Apple Pay. This eliminates the need for manual data entry and document submission, speeding up the transaction process and reducing friction, making it easier to buy Bitcoin or Ethereum.

Q. How does Meld’s Crypto Stack support Low KYC and one-click checkout?

Meld’s robust API enables developers to integrate onramps that offer Low KYC options, such as Paybis, Topper, and Blockchain.com. Meld’s customer score leverages past transaction performance and other factors to recommend the best onramp for successful transactions, enhancing user experience and maximizing conversion rates.

Q. What are the benefits of integrating Low KYC and one-click checkout for crypto users and companies?

For users, these features provide enhanced convenience, faster transactions, and a simplified experience, making it easier to buy cryptocurrencies like USDC, AVAX, and Polygon Matic. For companies, they lead to increased conversion rates, reduced friction in user onboarding, and improved customer satisfaction, driving growth in the dynamic Web3 ecosystem.